Businesses to Start in Saudi Arabia (2025): A Riyadh Guide for Foreign Founders

This guide is written for foreign founders and operators who are serious about turning Saudi Arabia -particularly Riyadh – into a primary market, operating base, or regional headquarters.

If you are a first-time founder exploring your first company outside your home country, you’ll find a pragmatic path from idea selection to first customers, mapped to the realities of licensing and compliance. If you’re a consultant or small agency owner (IT, HR, marketing, design, production, training), you’ll see how to productize services, price for local expectations, and structure retainers that travel well across Arabic/English buyers. If you’re a creative – producer, photographer, filmmaker, content studio – this guide explains where demand concentrates and how to schedule shoots, workshops, and client presentations efficiently. And if you’re an operator relocating to Riyadh to stand up a business unit, this playbook compresses your first ninety days: workspace, entity, banking, VAT, hiring, and business development.

Important note: This guide is practical and commercially focused. It is not legal or tax advice. Always verify regulatory details with qualified advisors and the relevant authorities before you commit funds or sign agreements.

Why Saudi, why now?

Saudi Arabia’s Vision 2030 agenda has accelerated diversification beyond hydrocarbons into technology, tourism, culture, logistics, manufacturing, healthcare, and renewables. The result is a pro-investment climate with sustained public and private spending on infrastructure, digital transformation, and human capital. For foreign founders, that translates into a market where buyers actively seek modern solutions, vendors that can deliver at international standards, and operators who can scale processes quickly.

Where opportunity concentrates – Riyadh as a headquarters city

Many national programs, corporate transformation initiatives, and regional headquarters strategies are coordinated from Riyadh. This creates dense demand for premium services – brand and content, IT implementation, data and analytics, training, compliance communications, and executive workshops. It also drives steady need for well-run meeting spaces, production studios, and professional environments where deals are advanced and teams align.

If you want to understand where these opportunities gather and which events shape the year, explore our full guide: Top 10 Business Events in Riyadh You Can’t Miss in 2025

| Sector | Market Dynamics | What “Fast” Means in Riyadh |

|---|---|---|

| Technology & Digital Services | Enterprise buyers modernize stacks in cloud, cybersecurity, AI, and automation. Specialized boutiques with KPIs win trust quickly. | Arrive with productized offers, bilingual proposals, and ready-to-run pilots that prove ROI in weeks. |

| Creative Industries & Content | Constant briefs from activations, conferences, and festivals. High demand for quick-turn content and bilingual delivery. | Deliver short-cycle projects with clear references, fast edits, and Arabic/English assets that reduce buyer risk. |

| Logistics & Last-Mile | E-commerce growth drives demand for returns handling, cold chain, and niche B2B courier routes. | Launch with process-obsessed service, predictable SLAs, and quick wins with 2–3 loyal anchor accounts. |

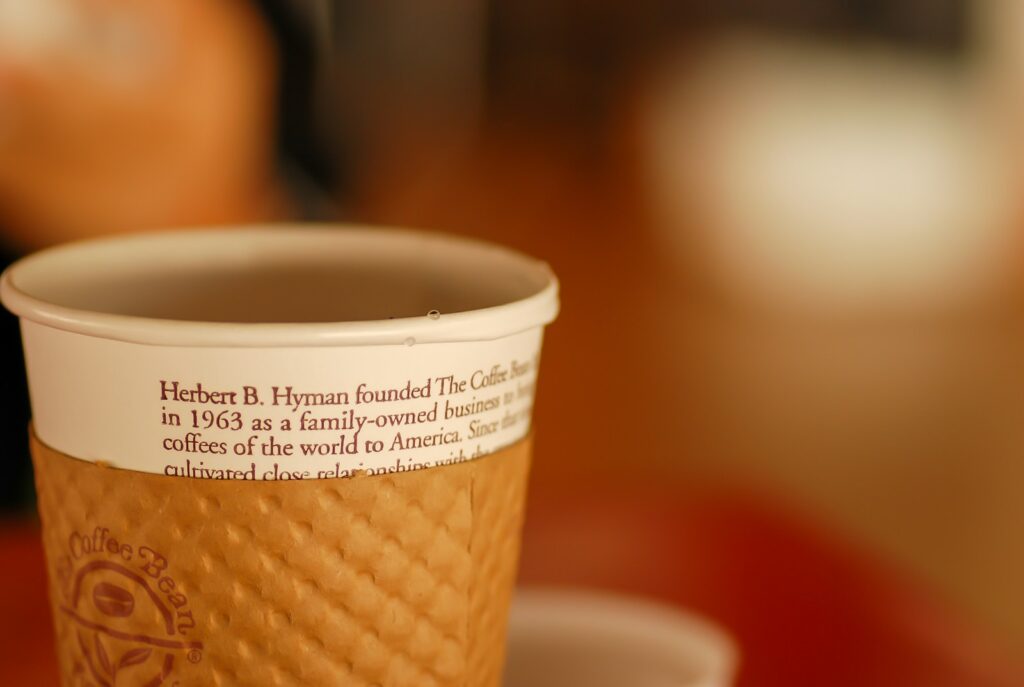

| Food & Beverage / Wellness | Consumers seek differentiated concepts – specialty coffee, concept dining, boutique fitness. | Pilot through pop-ups or limited menus before fit-out. Gather data early, then scale with confidence. |

| Tourism Experiences | Domestic and international flows create demand for curated itineraries, cultural, and corporate experiences. | Offer pre-packaged experiences with strong visuals, corporate-ready proposals, and seasonal flexibility. |

| Renewables & Energy Services | Driven by Vision 2030 sustainability targets. Need for audits, installation, and training. | Localize proven playbooks. Package services with clear O&M documentation and compliance alignment. |

Fast decision map (choose your model in 5 minutes)

What business should you start in Riyadh?

Answer 10 quick questions. Get a focused recommendation at the end.

Low-to-medium barrier business ideas (lean, services-first)

Boutique consulting (IT/HR/marketing/commercial strategy)

| Who it’s for | Operators and ex-managers who have fixed real business problems before. |

|---|---|

| What you sell | Quick audit → clear plan → 30-day fix. IT, HR, or marketing basics, with Arabic/English outputs. |

| How you charge | Three packs: Start (assessment), Pilot (one use case), Scale (rollout). Retainer for monthly reviews. |

| How you work | Week 1 interviews and data → Week 2 plan → Weeks 3–4 delivery and handover. |

| First 30 days | Publish 1 case study; secure 2 meetings per week in a proper meeting room. |

| Signs it’s working | Leaders invite you to decision calls; they ask you to stay on. |

| Common risks | Scope creep; changing stakeholders; slow decisions. Fix with clear scope and weekly decisions. |

Digital studio/agency (brand, content, UX/UI, performance)

| Who it’s for | Designers, content makers, and performance marketers who ship on deadlines. |

|---|---|

| What you sell | Brand refresh, key UX screens, and launch content with basic ads and analytics. |

| How you charge | Short sprints (2–4 weeks) or monthly retainers (3–6 months). Simple SLAs. |

| How you work | Brief → moodboard → templates → shoot/edit → publish → review results. |

| First 30 days | One “hero” video + cutdowns and a bilingual landing page with tracking. |

| Signs it’s working | Clients want a monthly content calendar; ad costs fall; conversions rise. |

| Common risks | Slow approvals; no plan for distribution; team overload. Use templates and a freelancer bench. |

E-commerce enablement and last-mile services

| Who it’s for | Ops-minded people who enjoy systems, checklists, and SLAs. |

|---|---|

| What you sell | Store setup, payments, clean product pages, promo calendar, courier and returns coordination. |

| How you charge | One-off build fee + monthly operations retainer. Courier costs passed through. |

| How you work | Fix data → set payments → set shipping → test returns → track weekly numbers. |

| First 30 days | Launch a small catalog, run one promo, test the returns flow end-to-end. |

| Signs it’s working | Fewer cancellations, fewer “where is my order?” tickets, promos ship on time. |

| Common risks | Taking inventory risk; platform lock-in. Stay coordinator and keep data portable. |

Content/production house (shoots, podcasts, social video, event recaps)

| Who it’s for | Shooters, editors, and producers who like fast, tidy delivery. |

|---|---|

| What you sell | Event recaps, product photos/video, and podcast packages with quick turnaround. |

| How you charge | Day rates with simple bundles; optional monthly day-credit retainer. |

| How you work | Plan and shot list → capture → edit and captions → review → deliver assets. |

| First 30 days | Deliver one event pack and one product pack; make a short reel. |

| Signs it’s working | Clients rebook you and pre-block dates; edits get faster with templates. |

| Common risks | Vague briefs, bad audio, late feedback. Lock shot lists, carry backup mics, set review windows. |

Insight: Event-Driven Growth

Riyadh’s business environment is event-heavy. From technology weeks and fintech conferences to cultural festivals, buyers often compress months of decisions into event windows. That means timing matters: a well-prepared founder can walk away from one week of events with a pipeline that would take months elsewhere. The key is to prepare bilingual collateral, clear packages, and pilot-ready offers before you attend. After the event, speed of follow-up often determines whether leads convert. Using a coworking base like R House helps – you can host meetings, capture content, and move quickly without losing time to logistics.

Training & workshops (AI enablement, marketing ops, sales playbooks, presentation/media)

| Who it’s for | Subject experts who explain clearly and like teaching teams. |

|---|---|

| What you sell | AI basics for teams, marketing ops, or sales playbooks with hands-on exercises. |

| How you charge | Per group (cohort) with optional follow-up clinics and office hours. |

| How you work | Short survey → tailored agenda → live session → action plan → office hours. |

| First 30 days | Run one open class; collect quotes; post a 2-minute highlight video. |

| Signs it’s working | Managers ask for team sessions; your templates show up in daily work. |

| Common risks | Silent rooms, no follow-through, unclear goals. Use live exercises and agree 3 success metrics. |

Higher-growth plays (more setup, bigger upside)

| Sector | Key Success Factors | Practical Tips | Risks & Compliance |

|---|---|---|---|

| Food & Beverage (Specialty Coffee, Fusion Casual) | Concept clarity, location discipline, strong unit economics | Start as pop-up/kiosk, test 2–3 hero products, use modular prep for consistency | Permits, utilities, fit-out timing. Prioritize ventilation & cold storage over décor. Staff reliability is key. |

| Wellness & Fitness Studios | Timetable engineering, instructor quality, membership design | Pick districts with easy parking. Offer onboarding + packs. Stack classes logically, use waitlists. | Client safety, cultural sensitivity, equipment logs. Retain instructors with fair compensation and training. |

| Logistics Services | Focused service scope, reliable SLAs, process obsession | Start with 2–4 static routes. Track exceptions weekly. Integrate with merchant systems. | Vehicle permits & insurance. Cold chain needs documented temperature monitoring & corrective actions. |

| Renewable Energy Services | Audit quality, procurement packs, O&M documentation | Offer tiered audits. Provide facility training & preventive maintenance plans. | Do not act as EPC. Clarify liability boundaries. Vet installers and document commissioning properly. |

| Tourism & Experiences | High production value, seamless logistics, repeatable excellence | Design half-day modules. Partner with hotels & DMCs. Adapt to seasonal heat with evening or indoor offers. | Use professional vendor agreements, insurance, and detailed client guidance (attire, timing, cultural notes). |

Insight: Understanding Nitaqat

Nitaqat is Saudi Arabia’s national workforce localization framework. It sets Saudization targets based on sector and company size. Instead of treating it as an end-of-year compliance exercise, founders should integrate it into organizational design from day one. That means identifying roles naturally suited for Saudi nationals – client services, operations coordination, junior analysts – while investing in training and career progression paths. When bidding for projects or onboarding with large enterprises, your Saudization strategy and training plan can directly influence vendor evaluation, making early planning a competitive advantage.

F&B concepts with a twist: specialty coffee, fusion casual, health-forward menus

Well-executed F&B in Riyadh can scale quickly, but success is driven by concept clarity, location discipline, and rigorous unit economics. A specialty coffee or fusion-casual concept benefits from a pop-up → permanent plan: validate menu–market fit and operational rhythm before committing to full fit-out.

Concept and product strategy

Begin with a narrow signature lineup that travels well (temperature, delivery time, packaging) and can be produced with consistent quality by a small team. For coffee, that often means two to three signature beverages, one alternative milk standard, and a rotating single-origin or seasonal option. For fusion casual, define a modular prep system that keeps back-of-house complexity low – common bases, interchangeable toppings, precise portioning.

Location and daypart design

Riyadh footfall patterns hinge on commuter corridors, destination malls, mixed-use complexes, and office clusters. Map where your target customers actually spend their weekday afternoons and evenings; weekends behave differently and can skew decision-making. Build daypart calendars explicitly: pre-work coffee, lunch rush, late-afternoon social, and evening families. Schedule labor and production to hit those peaks without waste.

Unit economics and menu engineering

Model contribution margins by SKU before you design the store. Use a simple framework: price – (ingredients + packaging) – variable labor minutes – delivery commission = contribution. Rank SKUs by contribution and prep time to shape the menu and featured items. Audit waste (milk, pastry, sauce batches) weekly and implement a pull-to-par system rather than pushing full batches every morning.

Operations and expansion plan

Pilot as a counter in a shared venue, dark kitchen, or short-term kiosk, then transition to a permanent site once you prove repeat purchase and operating cadence. Document all workflows: opening/closing, prep, inventory, cleaning, cash-up, reconciliation, vendor intake, and incident logs. Codify your supplier SLAs (temperature on receipt, substitution rules, lead times) and maintain two approved vendors per critical input.

Compliance, fit-out, and staffing

Budget realistic timelines for permits, inspections, and utilities. Fit-out should prioritize ventilation, water, drainage, cold storage, and durable surfaces over décor early on; brand polish can layer in later. Staff for reliability over showmanship: a duty manager who can schedule, receive, reconcile, and train is more valuable than an additional barista at peak.

Wellness & fitness studios: reformer Pilates, functional training, women-led formats

Demand is robust for boutique fitness with clear programming, immaculate facilities, and precision scheduling. Success comes from three levers: timetable engineering, instructor quality, and membership design.

Neighborhood selection and access

Prioritize districts with a high concentration of residential communities, offices, and easy parking. A five-to-seven minute walk from parking to studio materially affects no-show rates and class fill. Study school calendars and commute windows; early-morning and early-evening slots often become anchors, with mid-morning or lunchtime programming for parents and flexible professionals.

Scheduling dynamics

Build a timetable that clusters complementary classes (e.g., reformer foundations before a strength session) to encourage stacking. Keep cross-over buffers tight to minimize dead time but sufficient for cleaning and client turnover. Use waitlists aggressively and track show vs. book ratios per instructor and timeslot; adjust supply weekly until utilization stabilizes.

Product and pricing

Sell a foundations path (onboarding assessment + two starter classes), then convert to class packs or recurring memberships. Tier memberships by usage frequency and booking priority; high-value clients want guaranteed access to peak slots more than a nominal discount. Introduce specialty tracks – pre/post-natal, mobility, athletic conditioning – only after core utilization is predictable.

Instructor quality and retention

Your lead instructors are the brand. Standardize programming templates and cueing language while preserving instructor personality. Institute quarterly skills refresh and safety drills; capture best-practice sequences as video references. Compensation should blend base class rate, utilization bonus, and retention incentives to reduce churn.

Compliance and safeguarding

Maintain equipment logs, cleaning protocols, and incident reporting. Clear written policies on client screening, late arrival, and cancellations reduce friction. Ensure privacy and cultural expectations are respected in space layout and operations.

Logistics services: niche B2B courier, returns management, cold chain coordination

Riyadh’s growth in retail and e-commerce creates durable demand for reliable, narrow-scope logistics operators. Rather than building a broad network, win with a focused service – time-definite B2B courier between districts, white-glove deliveries for specialty items, or returns orchestration that integrates with merchants’ platforms.

Service definition and SLAs

Design one service at a time with explicit SLAs: pickup windows, delivery cut-offs, proof of delivery standards, and exception handling. For returns, define triage rules (restockable vs. refurbish vs. dispose) and integrate with merchant RMAs. For cold chain, document temperature bands, monitoring methods, and corrective actions.

Route and capacity planning

Start with a two-to-four route model, fixed time bands, and predictable district groupings. Use static routes initially to build driver familiarity and customer trust; incremental optimization can follow once volumes justify it. Track first-attempt success rate, dwell time, and exception categories weekly.

Partnerships and tech

Partner with reputable 3PLs for overflow, and integrate with merchant platforms for label generation, tracking events, and invoice reconciliation. Keep technology lean: a driver app for scanning and PoD photos, a dispatcher dashboard, and a merchant portal with live status and CSV export.

Compliance and risk

For vehicles, ensure registration, insurance, and any required permits are current. For cold chain, maintain calibrated thermometers or loggers and keep records. Train drivers on customer service scripts, handling disputes, and reporting near misses.

Renewable-energy services: audits, installation coordination, O&M documentation and training

You don’t need to be an EPC to build a viable business. A services-only model – site audits, financial/production modeling, design coordination, and O&M documentation with staff training – addresses a major capacity gap as adoption rises.

Offer structure

Lead with a tiered audit: consumption profiling, roof/site assessment, shading analysis, indicative production and payback models. Provide a procurement pack vendors can quote against (drawings, specs, bill of materials, performance targets). Post-install, deliver O&M playbooks, preventive maintenance calendars, and on-site training for facility teams.

Risk and quality control

Your liability is process integrity. Declare boundaries: you coordinate and verify documentation; licensed contractors execute electrical work. Maintain a vetting list for installers and require references, insurance, and as-built documentation. Use commissioning checklists and performance acceptance criteria agreed upfront.

Market entry plan

Start with SMEs and mid-size facilities where decision paths are shorter. Document two to three case studies (before/after load profiles, actual vs. modeled performance) to move upmarket.

Tourism & experiences: premium itineraries, corporate offsites, creative/photo experiences

As visitor numbers increase, curated experiences with high production value and seamless logistics stand out. Focus on segments you can serve with repeatable excellence: executive offsites, culinary/design tours, or photo-forward itineraries for creators and brands.

Product design

Think in modules: half-day experiences that combine a guided element, a premium venue, and a content opportunity. For offsites, provide turnkey facilitation (goals, agenda, workshops, meals, ground transport). For creator experiences, include location permissions, time-of-day planning, and on-site production support.

Distribution and seasonality

Secure anchor partnerships with hotels, DMCs, and corporate travel desks. Temperatures drive scheduling; design evening or indoor alternatives during hotter months and promote early-morning golden-hour slots for content shoots. Keep a rolling permits calendar and buffer times for approvals.

Risk and client assurance

Use professional vendor agreements, insurance certificates, and contingency plans. Provide guests with precise joining instructions, attire guidance, and cultural notes to minimize friction.

Entity & ownership basics (LLC vs branch vs JV; where 100% foreign ownership applies)

LLC: flexible, familiar, and usually the best default for SMEs

An LLC is the common choice for small and mid-sized foreign-owned operators. It offers operational flexibility, the ability to hire and contract locally, and clear governance through an articles of association and a shareholder register.

When an LLC fits best

Choose an LLC when you need a clean, standalone entity that can sign leases, open bank accounts, invoice clients, and sponsor employees. It aligns well with services businesses (consulting, studios, training), e-commerce enablement, niche logistics coordination, and many forms of creative production.

Governance and capital notes

Document board/resolution mechanics for major decisions (capital, dividends, director appointments) and minor operational decisions to keep pace without constant shareholder meetings. Align paid-in capital with your first-year operating plan and banking requirements rather than a notional minimum; right-size so that vendor onboarding and lease negotiations are smooth, and cash buffers cover realistic ramp time.

Insight: Residency Pathways

Saudi Arabia now offers several Premium Residency options for foreign founders, ranging from renewable one-year permits to long-term “green card” style residencies. These are especially valuable for entrepreneurs who want to avoid constant visa renewals and demonstrate commitment to the market. Pathways are open for investors, highly skilled professionals, and entrepreneurs with strong business plans. The benefits go beyond ease of living – residency often helps when opening bank accounts, signing leases, and applying for government programs. If you plan to build in Riyadh long term, exploring Premium Residency early can remove friction from daily operations and speed up trust with local stakeholders.

Branch: extend an overseas parent when continuity matters

A branch is a legal extension of an existing foreign company. It can simplify brand continuity and global reporting, and in some cases can expedite enterprise onboarding where buyers prefer contracting with a recognized parent.

When a branch helps

If your Saudi presence is meant to serve existing multinational contracts, or you need to show a continuous global entity (e.g., for certifications, warranties, or IP ownership), a branch may be preferable. It can reduce duplication in global compliance, but it also ties local risk directly to the parent entity, so weigh that carefully.

Practical considerations

Branches can be subject to activity restrictions depending on the sector. Banking and KYC may require enhanced documentation from the parent, including audited financials and board resolutions. Confirm your ability to invoice locally in the manner your customers expect (currency, VAT treatment, e-invoicing systems) before choosing this path.

JV: local partner advantages for restricted or relationship-heavy sectors

A joint venture with a local partner can unlock restricted activities, accelerate market entry through existing relationships, and de-risk procurement and hiring. It also introduces governance complexity that you must manage from day one.

Why and when a JV makes sense

Consider a JV when your sector benefits meaningfully from local relationships (e.g., certain public-sector projects, regulated activities, premises-dependent concepts) or when policy encourages local participation. The partner’s value must be tangible – access, distribution, or operational assets – not just a quota filler.

Control, IP, and exit planning

Write a thorough shareholders’ agreement that covers reserved matters, deadlock resolution, non-competes, IP ownership, data custody, funding obligations, drag/tag rights, and exit triggers. Clarify brand/IP licensing to the JV (scope, term, revocation rights) so that global brand integrity is preserved if the relationship ends. Keep operational continuity plans – what happens to clients, staff, and assets in adverse scenarios.

100% foreign ownership: where permitted and why a partner can still help

Many activities permit 100% foreign ownership subject to license and activity code alignment. Even when full ownership is allowed, a capable local partner can compress timelines: navigating premises, vendor onboarding, talent pipelines, and introductions to target accounts. Consider light-touch cooperation models – commercial agency, subcontracting, or preferred supplier frameworks – if you want the benefits of local leverage without equity entanglement.

Practical lens for choosing ownership structure

Ask four questions:

- Is a local partner legally required in your chosen activity?

- Will a partner materially accelerate access to premises, permits, or buyers?

- Does equity reflect true value vs. a commercial agreement?

- Can you unwind the arrangement without losing brand, clients, or critical staff?

Document the answers before you file. Treat ownership as a commercial instrument, not a trophy.

Banking & operations: account opening, payments readiness, invoicing norms

A Saudi entity that intends to trade needs a local bank account and a practical payments and invoicing stack. These are not afterthoughts; they determine how fast you can start billing and how smoothly procurement teams can onboard you.

Bank account opening

Prepare a documentation pack: constitutional documents (AoA, CR), licenses, signatory IDs, proof of address, board resolutions, and – in the case of branches – parent financials. Anticipate KYC interviews with named signatories. Right-size your opening balance to cover three to six months of operating expenses and deposits (lease, utilities).

Payments readiness

Decide early whether you need merchant acquiring/POS (retail, F&B, wellness) or invoicing and bank transfer (B2B services). If you take card payments on-site, ensure the checkout flow supports local schemes and receipts. If you invoice, standardize payment terms, include clear remittance instructions, and keep an eye on DSO from month one.

Invoicing and e-invoicing hygiene

Create bilingual invoices with your legal details, activity descriptors, and tax lines where applicable. Many buyers expect e-invoicing workflows; align your system to export the required formats and store archives in an audit-friendly structure. Set a monthly close process: reconcile bank statements, issue credit notes where needed, and prepare VAT/Zakat working files to avoid quarter-end scrambles.

Vendor onboarding and procurement

Large customers may require a vendor packet: CR, licenses, bank letter, W-9 equivalent forms where relevant, insurance certificates, and a data handling statement. Maintain this packet in a single folder with consistent file names to reduce the back-and-forth during onboarding.

Operating cadence

Adopt a Monday metrics ritual: cash position, receivables aging, pipeline, project status, and staffing capacity. Use a Friday close checklist: invoices issued, expenses logged, timesheets approved, deliverables archived. These small routines keep execution crisp and reassure enterprise buyers that you are reliable.

Avoid These Mistakes (Save Months)

Underestimating Capital Runway and Fit-Out Costs

Too many plans ignore deposits, fit-out, utilities, compliance alterations, and the first three months of uneven revenue. Build a cash map that includes licensing, legalizations, insurance, initial equipment, and the lag between invoice and payment. Stage spend: validate with a pop-up or temporary space before committing to permanent infrastructure. Tie every capex item to a revenue hypothesis and a payback window.

Picking the Wrong License Class or Activity Code

Marketing labels don’t equal legal activities. Misaligned codes trigger rework at banks, landlords, and regulators. Write your intended services in plain terms, map them to specific activity codes, and check any edge cases that look like training, media production, food handling, education, or energy. If in doubt, narrow the scope and add activities later rather than over-claim now.

Operating as an Individual When a Company Is Required

Large customers will not onboard individuals for recurring work, and many activities require a local legal entity. Incorporate early enough to contract, invoice, and hire. Keep a clean vendor packet ready – CR, licenses, bank letter, tax registration, insurance certificate, and data handling statement. The credibility lift alone shortens sales cycles.

Skipping VAT/Zakat and Sector Compliance Basics

Don’t postpone ZATCA registration, invoice formatting, or e-invoicing setup. Get your invoicing tool and numbering convention right before the first sale. If your sector requires pre-approvals or inspections, do them before you sign leases or announce launch dates. Keep bilingual contracts with clear scopes and termination terms; archive everything.

Overbuilding Before Validation, Under-Localizing Brand and Offer

Perfect studios, complex kitchens, or full teams without paying customers burn runway. Prove demand with a minimum viable offer, a small equipment kit, and borrowed rooms. Localize copy, pricing, and processes for Arabic and English from the start. Use examples, metrics, and artifacts that look and read like they belong in Riyadh. Cut scope to ship faster; expand only what the market pulls.

R House: Your Base to Work, Meet, and Grow

Whether you’re looking for a creative studio space, a place at our shared desks or a private office for you and your team, R Memberships are tailored to meet your needs. In a central Riyadh location close to leading retail, hotels, restaurants, and cafes – and under 30 minutes from the airport – you get an intuitively designed, progressive, professional environment that makes real work easier and meetings more effective. The house blends contemporary studios, dedicated workspaces, and thought-provoking events to facilitate creative thinking, collaboration, and innovation across disciplines.

Next step: schedule a tour, see the rooms, and choose the membership that fits your current stage. If you prefer to talk first, email info@rhouse.co or call 0112011102. With a central base, client-ready rooms, and content-friendly studios, R House shortens the distance between first meeting and signed scope.

FAQ – Businesses in Saudi Arabia

Can foreigners own 100% of a business in Saudi Arabia?

Yes. In many sectors, foreign founders can establish a Limited Liability Company (LLC) with full ownership. However, some industries still require a local partner, particularly in strategic or regulated areas.

What is the first step to start a business in Riyadh?

The process begins with obtaining an investment license from the Ministry of Investment (MISA), followed by Commercial Registration with the Ministry of Commerce.

How much capital is required to open a business?

Capital requirements vary by sector. Some services require only minimal capital, while industries such as food, education, or energy may need higher initial investment for licenses, premises, and staffing.

Do I need to hire Saudi nationals from the start?

Yes, under the Nitaqat program, companies are expected to hire Saudi nationals. The required ratio depends on company size and sector, so early workforce planning is important.

Which sectors have the best opportunities in 2025?

Promising sectors include technology and digital services, creative industries, logistics and last-mile delivery, food and beverage, wellness, renewable energy, and tourism experiences.

What taxes apply to new businesses?

Most businesses must register for VAT with the Zakat, Tax and Customs Authority (ZATCA). Zakat applies to Saudi-owned entities, while foreign-owned entities pay corporate income tax.

How long does it take to register a company?

If documents are complete, company setup can take 6–12 weeks, depending on sector-specific approvals and licensing. Allow extra time for regulated industries such as health or education.

Do I need an office space to register?

Yes, a local business address is required for Commercial Registration. Many startups choose coworking spaces like R House in Riyadh for flexibility and compliance.

What mistakes should new founders avoid?

Common mistakes include selecting the wrong business activity code, underestimating capital needs, delaying VAT registration, and neglecting Saudization requirements.

Where can I find support and networking opportunities?

Founders can access Monsha’at SME support, join local accelerators, attend Riyadh’s growing business events, and work from R House coworking to connect with startups, creatives, and investors.